Corporate

Commentary published on January 11, 2023

Q1 2023 Corporate Bond Market Outlook

Summary

- With a cumulative fed funds increase of 125 basis points (bps) in 4Q and guidance for continued hikes in 2023, the Federal Reserve (Fed) showed that cutting inflation remains its top priority.

- In the U.S., investors appeared hopeful that the Fed would relent in the face of improving inflation readings during 4Q.

- Investment grade (IG) corporate bonds, as measured by the Bloomberg (BBG) U.S. Corporate IG Index (the Corporate Index),[1] delivered positive total and excess returns in 4Q, while year-to-date returns were negative.

- Yields on IG corporate bonds were sustained at the highest levels in more than a decade.

- In our view, operating trends for IG issuers will weaken as demand falls. FactSet estimates an average S&P 500 fourth quarter earnings decline of about 3 percent which, if realized, will mark the first year-over-year S&P 500 earnings decline since 3Q/2020 when it was 5.7 percent. [2]

- While outflows plagued IG funds during most of 2022 and new issuance was below trend on volatility, signs may be pointing to somewhat higher issuance, especially early in 2023.

- Looking ahead, we expect volatility and some spread widening pressure, but relatively high all-in yields may attract flows into IG fixed income.

- Environmental, social, and governance (ESG) considerations remained top-of-mind as regulatory and legislative initiatives bolstered efforts to adapt, manage, and mitigate ESG risks. Meanwhile, opponents and proponents of factoring in ESG analysis in security analysis pushed their agendas. Breckinridge maintained its stance that ESG in security analysis is additive to the effort to identify and understand certain nonfinancial risk factors in investment decision making.

Investment Review and Outlook

Hoping the Rate-Hiking Cycle Was Nearing an End, Investors Returned to Risk Markets

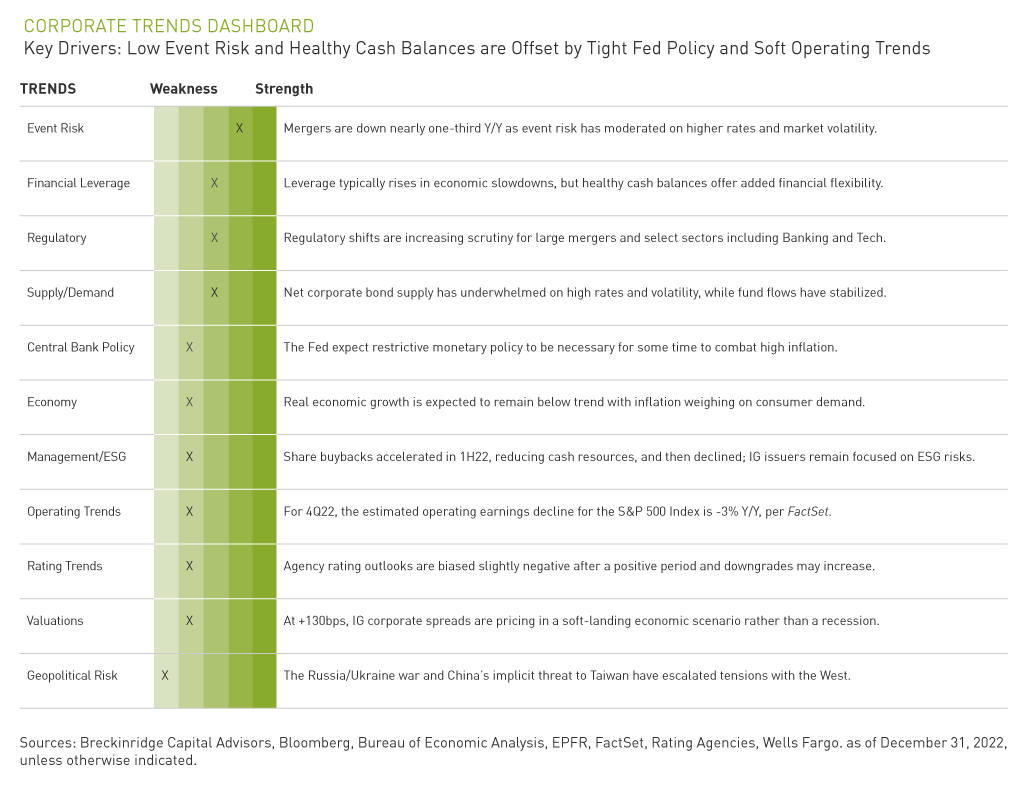

We enter 2023 with the view that IG fixed income offers value with all-in yields above 4 percent in most terms and IG products. The yield on the Index is above 5 percent, the highest it’s been in more than 10 years. We are defensively positioned with corporates, as spreads may widen over the course of 2023, as the risk of a U.S. economic recession seemingly increases. Technicals have improved at the margin, with the recent sharp decline in net corporate supply and the prospect for improved flows into taxable fixed income markets. Credit fundamentals are weakening, with slowing profit growth and elevated leverage partially offset by solid cash balances and a healthy U.S. banking sector.

Fundamentals

Earnings are Expected to Slow as Fed Rate Hikes Impact Demand

For 4Q2022, the estimated operating earnings decline for the S&P 500 Index6 is 3 percent year-over-year (Y/Y), per FactSet (See Figure 1). For fiscal year 2022 (FY22), net earnings are expected to grow 5 percent Y/Y, with profit margins down slightly.

Energy is forecasted to be the largest sector contributor to earnings growth for the S&P 500 Index for FY22. Excluding Energy would force earnings growth down to about negative 2 percent Y/Y rather than 5 percent Y/Y.

For FY23, consensus growth is 5 percent, in line with FY22, which is noteworthy given the expected impact of rate hikes on demand.7 4Q22 earnings will be informative as issuers offer 2023 outlooks.

Leverage May Rise and Spread Compensation is Below Average

IG net leverage is expected to end 2022 near 3.0 times. As we think about 2023, we observe that in the past four U.S. recessions, net leverage moved up an average of 0.5 times, peak-to-trough.8

Spread compensation per unit of leverage was 46bps at year-end 2022 (YE22), up from 31bps at YE21, but below the long-term average of 64bps (See Figure 2). We would expect spread compensation to increase during 2023.

The Index moved 29bps tighter in 4Q22, but was still 40bps wider year-to-date (YTD), finishing at an option adjusted spread (OAS) of 130bps.9 The yield on the Index moved from 2.36 percent at YE21 to 5.26 percent at YE22.

Capital Allocations Decisions May Shift as Economic Conditions, Tax Policies Change

A number of factors may influence capital allocation decisions as well as mergers and acquisition (M&A) activity in the months ahead.

For example, the Inflation Reduction Act (the Act) created a 15 percent alternative minimum tax on large companies earning an average of more than $1 billion annually beginning in 2023. In addition, the Act also imposed a new annual excise tax that applies to repurchases of a publicly traded corporation’s stock that take place after December 31, 2022.10 The Department of the Treasury released guidance on the two new taxes in late-December including the types of transactions subject to the excise tax and how it is calculated. How corporations choose to allocate capital in light of the new tax burdens bears watching.

In general, M&A activity declined in 2022 compared to 2021. Reuters reported on December 21, that M&A activity globally “fell well short of the high-water mark set last year.” The report acknowledged that 2021 levels may have been unsustainable and debt financing markets challenges and stock market volatility that reduced valuations exacerbated conditions. Total M&A value fell 37 percent by December 20, according to Dealogic data, after a record $5.9 trillion in 2021.11

With regard to shareholder dividends, Wall Street Horizon reported in December that the number of companies announcing lower dividends increased over the past two quarters, while the number increasing them fell, based on the portion of dividend-paying stocks in the more than 9,000 global stocks followed by Wall Street Horizon. In the third and fourth quarters, 16 percent lowered dividends, up from 14 percent and 12 percent in the last two quarters of 2021. There has been a corresponding decrease in the percentage that have announced higher dividends, with 21 percent doing so in the past two quarters compared with 25 percent in each year-earlier period.12

Technicals

Decrease in Net Corporate Supply on Higher Rates and Volatility

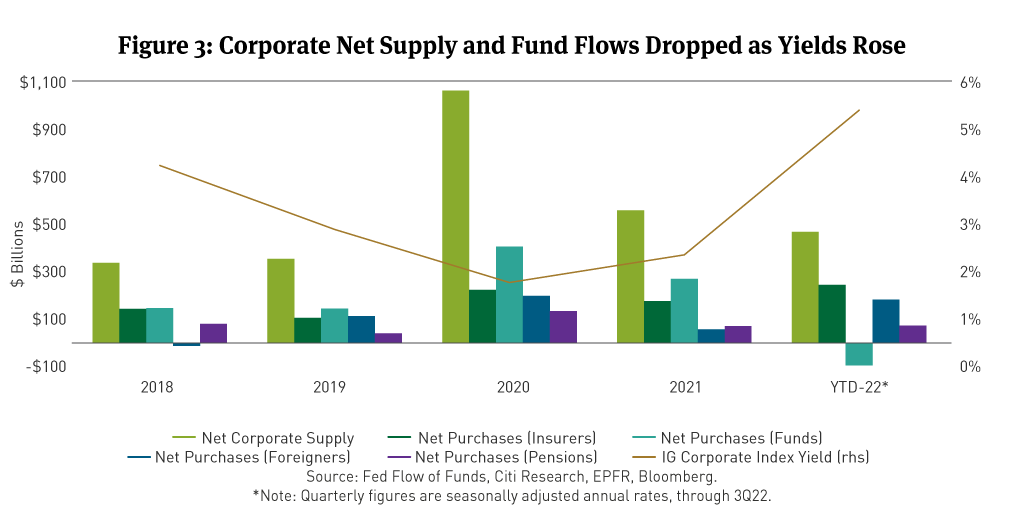

Net corporate supply underwhelmed in the second half of 2022 on higher rates and volatility (See Figure 3). Moreover, elevated refinancing in prior quarters and high cash balances contributed to a decline.

Given negative total returns, bond funds saw outflows during 2022 compared to strong inflows the prior year. However, with yields at their highest in a decade, fund inflows may pick up prospectively.

Foreign demand picked up during 2022 despite high U.S. dollar hedging costs. Pension buying was muted but should increase given higher corporate bond yields. Insurers were a steady source of demand.

There are signs suggesting a potential rebound in IG corporate bond issuance, especially early in the new year.

Reporting in December, Bloomberg commented, “Blue-chip companies are expected to storm the bond market in January before funding costs increase and the economy deteriorates.” Bloomberg cited a forecast for U.S. investment-grade bond sales to jump as high as $40 billion in the first week of 2023, more than four times what was issued in all of December.13

Valuations

Corporate Spreads Are Pricing in a Soft Landing, Not a Recession

Credit spreads for 10-year corporate bonds rated BBB are pricing in a soft-landing economic scenario rather than a U.S. recession. Current valuations are trading about 30bps inside of the average spread since 1988.

Looking at historical data BBB credit spreads have troughed near 150bps five times and peaked above 300bps five times. Spread peaks have coincided with earnings or economic recessions or other market shocks.

A 10-year/3-month Treasury yield curve inversion has preceded recession by an average of 11 months based on eight observations since 1969 of Federal Reserve Economic Data (FRED) compiled by the Federal Reserve Bank of St. Louis.14

With an inverted curve and recession risk, spreads may widen in 2023. Even mild or earnings recessions have seen IG spreads tend to peak in the 175 to 200bps range. Typically, outside of recessions stemming from the Great Financial Crisis and the COVID pandemic, in a hard-landing, economic recession scenario, spreads historically have widened to the 200 to 250bps range.

ESG Spotlight

During the fourth quarter, the growing influence of climate policy in global trade was evident. The U.S. Inflation Reduction Act includes, among other environmentally oriented initiatives, several climate-friendly industrial subsidies to bolster domestic investment. Meanwhile, European Union (EU) trade laws imposed a levy on high-carbon imports; made more urgent by the energy crisis stemming from Russia’s war in Ukraine.

Bloomberg noted in a report that, “The initiatives show how major economies are trying to create incentives to contain the damage from global warming while also keeping pace with high-stakes technological shifts.”

For its part, Breckinridge and other asset managers and financial institutions have advanced their efforts to focus attention on global efforts to limit global warming to 1.5 degrees Celsius. The stance is based on science showing evidence that if global temperature rise cannot be limited to less than 1.5 degrees Celsius compared to pre-industrial levels, dramatic consequences will follow, including natural disasters such as floods, more severe and frequent weather events, longer and more severe droughts, and food shortages exacerbated by a changing climate.

Writing in Harvard Business Review in December, Andrew Winston offered this view: “In truth, climate change and clean tech create enormous risks and opportunities for companies and deeply affect their profitability and prospects. Investors need to understand and incorporate those risks into their assessments.” Mr. Winston is an adviser and speaker on how to build companies that profit by serving the world. His books include Green to Gold, The Big Pivot, and Net Positive.

[1] The Bloomberg U.S. Corporate Bond Index is an unmanaged market-value-weighted index of investment-grade corporate fixed-rate debt issues with maturities of one year or more. You cannot invest directly in an index.

[2] Earnings Insight, FactSet, December 15, 2022.

[3] US Investment Grade Corporate Update, Barclays, as of November 30, 2022.

[4] US Investment Grade Corporate Update, Barclays, as of December 31, 2022.

[5] FRED, Federal Reserve Bank of St. Louis, https://fred.stlouisfed.org/

[6] The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. Itis a market-value-weighted index with each stock’s weight in the index proportionate to its market value. You cannot invest directly in an index.

[7] Earnings Insight, FactSet, December 15, 2023.

[8] US Investment Grade Credit Metrics, Q3 22 Update, Barclays Research, December 13, 2022.

[9] The Bloomberg US Corporate Bond Index, December 30, 2022.

[10] H.R.5376 - Inflation Reduction Act of 2022, 117th Congress.

[11] “Dealmakers brace for slow 2023 recover after M&A sinks,” Reuters, December 21, 2022.

[12] “Does a Spike in Dividend Decrease Announcements Portend 2023 Volatility?”, Wall Street Horizon, December 2022.

[13] Bond Issuers Plot New Year Blitz as Rates Rise, Economy Slows, Bloomberg Law, December 23, 2022.

[14] FRED, Federal Reserve Bank of St. Louis, https://fred.stlouisfed.org/.

[15] 2022: A Tumultuous Year in ESG and Sustainability, Andrew Winston, Harvard Business Review, December 21, 2022.

Disclosures:

This material provides general and/or educational information and should not be construed as a solicitation or offer of Breckinridge services or products or as legal, tax or investment advice. The content is current as of the time of writing or as designated within the material. All information, including the opinions and views of Breckinridge, is subject to change without notice.

Any estimates, targets, and projections are based on Breckinridge research, analysis, and assumptions. No assurances can be made that any such estimate, target or projection will be accurate; actual results may differ substantially.

Past performance is not a guarantee of future results. Breckinridge makes no assurances, warranties or representations that any strategies described herein will meet their investment objectives or incur any profits. Any index results shown are for illustrative purposes and do not represent the performance of any specific investment. Indices are unmanaged and investors cannot directly invest in them. They do not reflect any management, custody, transaction or other expenses, and generally assume reinvestment of dividends, income and capital gains. Performance of indices may be more or less volatile than any investment strategy.

Performance results for Breckinridge’s investment strategies include the reinvestment of interest and any other earnings, but do not reflect any brokerage or trading costs a client would have paid. Results may not reflect the impact that any material market or economic factors would have had on the accounts during the time period. Due to differences in client restrictions, objectives, cash flows, and other such factors, individual client account performance may differ substantially from the performance presented.

All investments involve risk, including loss of principal. Diversification cannot assure a profit or protect against loss. Fixed income investments have varying degrees of credit risk, interest rate risk, default risk, and prepayment and extension risk. In general, bond prices rise when interest rates fall and vice versa. This effect is usually more pronounced for longer-term securities. Income from municipal bonds can be declared taxable because of unfavorable changes in tax laws, adverse interpretations by the IRS or state tax authorities, or noncompliant conduct of a bond issuer.

Breckinridge believes that the assessment of ESG risks, including those associated with climate change, can improve overall risk analysis. When integrating ESG analysis with traditional financial analysis, Breckinridge’s investment team will consider ESG factors but may conclude that other attributes outweigh the ESG considerations when making investment decisions.

There is no guarantee that integrating ESG analysis will improve risk-adjusted returns, lower portfolio volatility over any specific time period, or outperform the broader market or other strategies that do not utilize ESG analysis when selecting investments. The consideration of ESG factors may limit investment opportunities available to a portfolio. In addition, ESG data often lacks standardization, consistency and transparency and for certain companies such data may not be available, complete or accurate.

Breckinridge’s ESG analysis is based on third party data and Breckinridge analysts’ internal analysis. Analysts will review a variety of sources such as corporate sustainability reports, data subscriptions, and research reports to obtain available metrics for internally developed ESG frameworks. Qualitative ESG information is obtained from corporate sustainability reports, engagement discussion with corporate management teams, among others. A high sustainability rating does not mean it will be included in a portfolio, nor does it mean that a bond will provide profits or avoid losses.

Any specific securities mentioned are for illustrative and example only. They do not necessarily represent actual investments in any client portfolio.

The effectiveness of any tax management strategy is largely dependent on each client’s entire tax and investment profile, including investments made outside of Breckinridge’s advisory services. As such, there is a risk that the strategy used to reduce the tax liability of the client is not the most effective for every client. Breckinridge is not a tax advisor and does not provide personal tax advice. Investors should consult with their tax professionals regarding tax strategies and associated consequences.

Federal and local tax laws can change at any time. These changes can impact tax consequences for investors, who should consult with a tax professional before making any decisions.

Some information has been taken directly from unaffiliated third-party sources. Breckinridge believes the data provided by unaffiliated third parties to be reliable but investors should conduct their own independent verification prior to use. Some economic and market conditions contained herein have been obtained from published sources and/or prepared by third parties, and in certain cases have not been updated through the date hereof. All information contained herein is subject to revision. Any third-party websites included in the content has been provided for reference only.

Certain third parties require us to include the following language when using their information:

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg does not approve or endorse this material or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.