Equities

Perspective published on October 17, 2025

Why Does a Credit Rating Matter for Dividend Investing?

Summary

- In our view, a credit rating is a measure of financial robustness and a proxy for quality, reflecting a firm’s proven results and history of prudent capital deployment.

- We believe that deep fundamental credit research is well equipped to identify firms that are of robust quality, defensive, and able to at least sustain, and ideally grow dividends over the long term.

- Credit research is inherently focused on downside risks and is a valuable addition in identifying firms that can be considered high quality dividend payers.

We believe that a credit rating is an all-encompassing indicator that provides more information than many other singular metrics. In essence, at its most broad definition, the credit rating is a signal that reflects the overall financial and business risk of a given firm and is a proxy for a firm’s overall quality.

There are three primary proof points around the relevance of a credit rating in identifying strong dividend payers:

-

Companies with high credit ratings are likely to focus on growth of dividends paid per share, avoid reducing dividends, and be reluctant to change dividends that may have to be reversed in the future.1

-

Companies that access public debt markets are concerned about the signals that their dividend policies send to the market. These firms are likely to exhibit Litner-style2 dividend smoothing that is less influenced by short term earnings.3

-

Overleveraged firms are less likely to increase dividends and are more likely to decrease them.4 Highly leveraged firms are more likely to have lower credit ratings.5

While at first glance a credit rating seems simple, there are a plethora of inputs involved in assigning a credit rating, which necessitates regular due diligence using careful quantitative and qualitative analysis by a credit analyst with expertise in each firm’s particular industry. Scale, diversification, capital structure, financial policy, management, as well as their competitive positioning and any industry risk factors, are ultimately incorporated into the analyst’s view on their rating. Evaluating the impact of these factors on balance sheet strength, cash flow stability, and a firm’s desire to maintain or improve its credit rating, is intuitively linked to a firm’s dividend stability.

A credit rating is directly related to the overall quality of a firm. Breckinridge maintains proprietary credit ratings that, when assessed in addition to other key inputs, contributes to our identification of high-quality dividend payers that we believe are more likely to sustain and grow dividends over time.

Philosophically, credit research places an emphasis on a firm’s proven results and history of prudently deploying capital. We believe that deep fundamental credit research is well equipped to identify firms that are of robust quality, defensive, and able to at least sustain, and ideally grow dividends over the long term. Credit research is inherently focused on downside risks and is a valuable addition in identifying firms that can be considered high quality dividend payers.

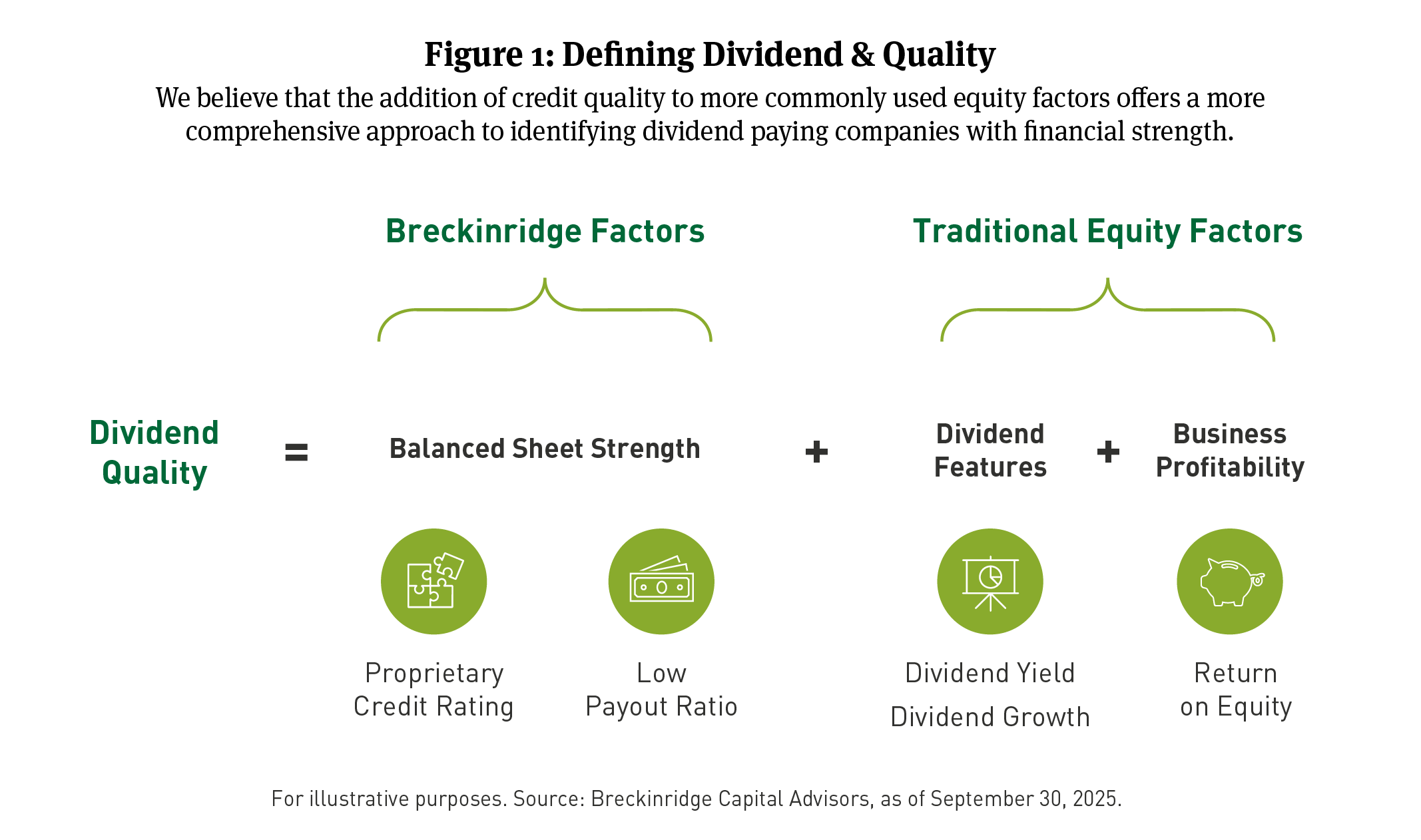

The Breckinridge High Quality Dividend Strategy and Sustainable High Quality Dividend Strategy utilize our proprietary credit ratings assigned by our in-house credit analysts. The strategies incorporate our credit rating as a scored factor when seeking to identify strong dividend-paying firms. When included with additional factors such as low payout ratios, elevated but not risky dividend yields, high dividend growth rates, and strong return on equity — it has the potential to better identify firms that exhibit strong dividend quality.

[1] Alon Brava, John R. Graham, Campbell R. Harvey, Roni Michaely, “Payout Policy in the 21st Century,” Journal of Financial Economics, September 2005.

[2] Litner-style dividend smoothing refers to a behavioral model of corporate dividend policy introduced by economist John Litner in the 1950s. It is a foundational concept in financial economics for understanding how firms decide on dividend payouts over time.

[3] Varouj A. Aivazian, Laurence Booth, Sean Cleary, “Dividend Smoothing and Debt Ratings,” Journal of Financial and Quantitative Analysis, June 2006.

[4] Armen Hovakimian, Ayla Kayhan, Sheridan Titman, “Credit Rating Targets,” presented at the NBER Corporate Finance Meeting, 2009.

[5] Ibid.

BCAI-10102025-x0ns4wbq (10/15/25)

DISCLAIMERS:

The content is intended for investment professionals and institutional investors.

This material provides general information and should not be construed as a solicitation or offer of services or products or as legal, tax or investment advice. Nothing contained herein should be considered a guide to security selection, asset allocation or portfolio construction.

All information and opinions are current as of the dates indicated and are subject to change. Breckinridge believes the data provided by unaffiliated third parties to be reliable but investors should conduct their own independent verification prior to use. Some economic and market conditions contained herein have been obtained from published sources and/or prepared by third parties, and in certain cases have not been updated through the date hereof.

There is no assurance that any estimate, target, projection or forward-looking statement (collectively, “estimates”) included in this material will be accurate or prove to be profitable; actual results may differ substantially. Breckinridge estimates are based on Breckinridge’s research, analysis and assumptions. Other events that were not considered in formulating such projections could occur and may significantly affect the outcome, returns or performance.

Not all securities or issuers mentioned represent holdings in client portfolios. Some securities have been provided for illustrative purposes only and should not be construed as investment recommendations. Any illustrative engagement or sustainability analysis examples are intended to demonstrate Breckinridge’s research and investment process.

Yields and other characteristics are metrics that can help investors in valuing a security, portfolio or composite. Yields do not represent performance results but they are one of several components that contribute to the return of a security, portfolio or composite. Yields and other characteristics are presented gross of advisory fees.

All investments involve risk, including loss of principal. No investment or risk management strategy, including diversification, can guarantee positive results or risk elimination in any market. Periods of elevated market volatility can significantly impact the value of securities. Investors should consult with their advisors to understand how these risks may affect their portfolios and to develop a strategy that aligns with their financial goals and risk tolerances.

Past performance is not indicative of future results. Breckinridge makes no assurances, warranties or representations that any strategies described herein will meet their investment objectives or incur any profits. Performance results for Breckinridge’s investment strategies include the reinvestment of interest and any other earnings, but do not reflect any brokerage or trading costs a client would have paid. Results may not reflect the impact that any material market or economic factors would have had on the accounts during the time period. Due to differences in client restrictions, objectives, cash flows, and other such factors, individual client account performance may differ substantially from the performance presented.

There is no guarantee that the strategies or approaches discussed will achieve their objectives, lower volatility or be profitable. All investments involve risk, including loss of principal. Diversification cannot assure a profit or protect against loss. No investment or risk management strategy can guarantee positive results or risk elimination in any market.

Fixed income investments have varying degrees of credit risk, interest rate risk, default risk, and prepayment and extension risk. In general, bond prices rise when interest rates fall and vice versa.

Equity investments are volatile and can decline significantly in response to investor reception of the issuer, market, economic, industry, political, regulatory or other conditions.