Investing

Perspective published on September 9, 2025

Tax-Loss Harvesting in Fixed Income Portfolios

Summary

- Separately managed accounts can offer the advantage of greater control of your tax liabilities through strategies such as tax-loss harvesting and tax-loss swapping.

- These capabilities can be particularly important during periods when interest rates change quickly, and sometimes dramatically, or when tax policy changes.

- In its tax-efficient strategies, Breckinridge employs certain tax-loss management strategies as market conditions warrant.

This article reviews tax-loss harvesting and tax-loss swapping concepts from Breckinridge’s portfolio management perspective. This article is not intended to be tax or investment advice. Since tax and financial situations can differ from one individual to the next, it is always advisable to consult with a tax professional or refer to the latest Internal Revenue Service guidelines to better understand how specific rules apply to individual circumstances.

Tax-Loss Strategies Can Lower Tax Liabilities

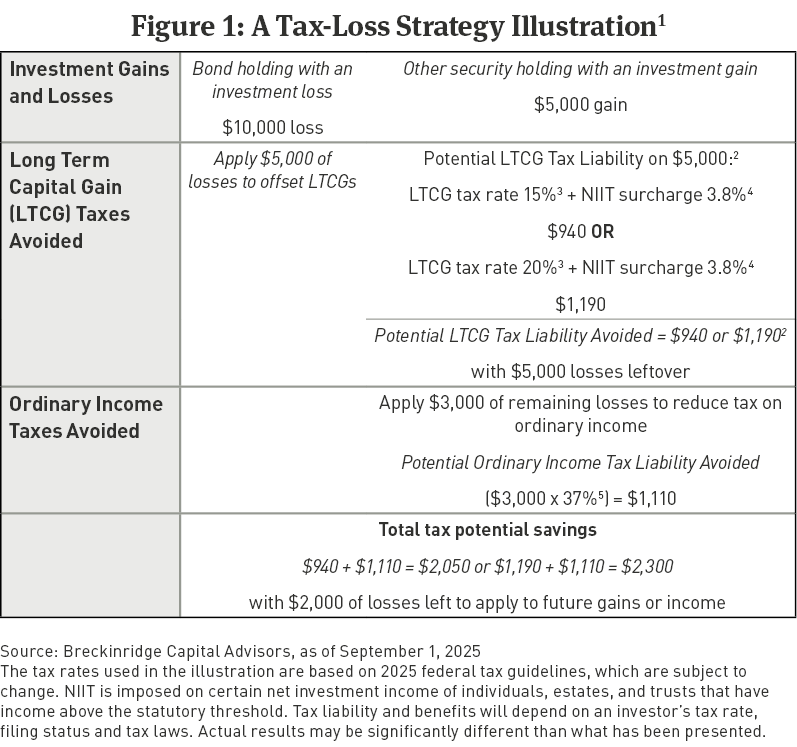

In bond investing, tax-loss harvesting involves selling one or more bonds in which an investor has unrealized capital losses and using those harvested losses to offset capital gains. If there are remaining losses after offsetting gains (in other words, net losses), an investor may also apply the losses to offset up to $3,000 of ordinary income in a year (or $1,500 for married individuals filing separately).

Investors may also be allowed to carry forward for tax purposes in future years additional net losses above this limit. Figure 1 illustrates a simple one-for-one investment example of how a realized loss may help reduce a tax liability for an investor.

With the goal of remaining fully invested in the market, proceeds from a sale are typically reinvested into another bond.

When reinvesting, it may make sense to strategically adjust portfolio holdings. In the example illustrated in Figure 1, an investor seeking to increase current income might use the sale proceeds to purchase bonds with higher coupons or to extend or shorten the maturity range of his or her bond portfolio.

Is there a difference between Tax-Loss Harvesting and Tax-Loss Crossing?

Tax-loss crossing is a form of tax-loss harvesting done concurrently between two separate investors. In a tax-loss cross trade, an investor sells a bond for which the market value has fallen below the purchase price, realizing the capital loss, and simultaneously buys a similar but not identical bond from a different investor. Cross trades may result in lower transaction costs than trading on the open market, and keep the assets invested while preserving overall structure and the investment strategy of the investment portfolio.

When Breckinridge conducts tax-loss crossing, we seek to purchase investments with some combination of similar maturity, quality, and coupon characteristics as the sold security. Our goal is to take part in the tax advantages of specific bonds while minimizing changes to the overall portfolio’s integrity.6

Be Prepared to Take Advantage of Opportunities

As interest rates rise, bonds will often incur unrealized capital losses. The last few years have illustrated, the speed and magnitude of rate increases can result in sizeable losses even for bonds that have high quality credit ratings. This is particularly true if interest rates are at absolute low levels preceding an upward shift in rates.

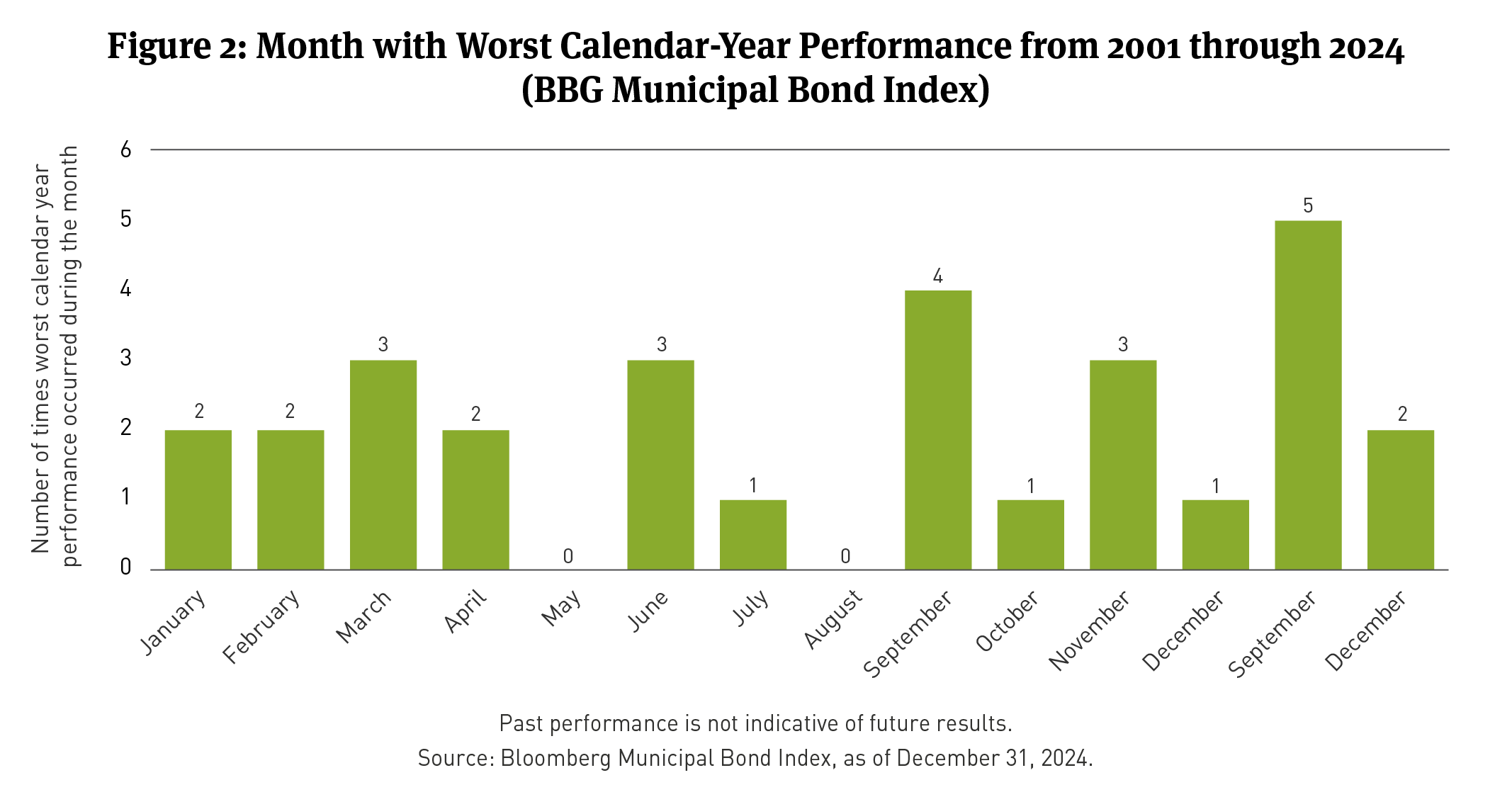

While conditions over the past few years have offered bond managers the ability to harvest losses, some investors may only think of, or execute on, tax-loss harvesting initiatives toward the end of the calendar year.

History has shown bond price declines due to increases in interest rates can happen throughout the year. As shown in Figure 2, using the broad Bloomberg Municipal Bond Index benchmark, we can see that it is often the case that the largest monthly losses may happen during earlier months of the year. Those losses may be reduced or potentially fully reversed by year end, thereby potentially eliminating the ability to capture a tax advantage, investing at higher average yields, and/or improving portfolio structure.

Avoid Wash Sales

A critical point in tax-loss harvesting and tax-loss swapping is to avoid wash sales. A wash sale occurs when an investor sells a bond and, within 30 days before or after the sale, purchases the same or a nearly identical bond as the one sold.

In the event of a wash sale, an investor is not allowed to use the loss on the sale to offset capital gains or to reduce taxable income. Investors can seek to purchase bonds that have characteristics—including issuers, maturities, or coupons—that differ from the bond sold.

Tax Loss Harvesting Can Help Manage Tax Liabilities

During periods when interest rates change or when tax policy changes, tax-loss harvesting strategies can offer opportunities to manage overall tax liabilities for individual investors. Unless directed by a client not to do so, Breckinridge employs tax-loss management strategies in its tax-efficient strategies, as market conditions warrant. Through our attentive approach, we seek to assess tax-loss opportunities throughout the year.

#BBCAI-09042025-4uabdsya (September 8, 2023)

[1] Based on 2025 federal tax guidelines, which are subject to change.

[2] Tax liability and potential savings depend on the individual’s tax rate, filing status, and tax laws; all of which may change and alter the results.

[3] Per Bankrate.com, for tax year 2024, the long-term capital gains tax rate for individual tax filers earning between $47,026 to $518,900 and tax filers filing jointly earning between $94,051 to $583,750 is 15 percent. The long-term capital gains tax rate for individual tax filers earning more than $518,900 and tax filers filing jointly earning more than $583,750 is 20 percent.

[4] The Net Investment Income Tax (NIIT) was created as part of the Health Care and Education Reconciliation Act by means of the reconciliation process, in order to amend the Affordable Care Act (ACA). The NIIT was intended to fund healthcare reform in 2010, the NIIT, imposed by section 1411 of the Internal Revenue Code, typically applies to high earners with considerable investment income. The NIIT applies at a rate of 3.8% to certain net investment income of individuals, estates and trusts that have income above the statutory threshold amounts.

[5] For tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $626,350 ($751,600 for married couples filing jointly).

[6] While Breckinridge generally selects bonds that, in its best judgement, will not change significantly in price, bonds nevertheless are subject to fluctuations in price, and the bonds received through tax loss crossing may go up or down in value.

DISCLAIMERS:

The content is intended for investment professionals and institutional investors.

This material provides general and/or educational information and should not be construed as a solicitation or offer of Breckinridge services or products or as legal, tax or investment advice. The content is current as of the time of writing or as designated within the material. All information, including the opinions and views of Breckinridge, is subject to change without notice.

There is no assurance that any estimate, target, projection or forward-looking statement (collectively, “estimates”) included in this material will be accurate or prove to be profitable; actual results may differ substantially. Breckinridge estimates are based on Breckinridge’s research, analysis and assumptions. Other events that were not considered in formulating such projections could occur and may significantly affect the outcome, returns or performance.

Past performance is not a guarantee of future results. Breckinridge makes no assurances, warranties or representations that any strategies described herein will meet their investment objectives or incur any profits. Any index results shown are for illustrative purposes and do not represent the performance of any specific investment. Indices are unmanaged and investors cannot directly invest in them. They do not reflect any management, custody, transaction or other expenses, and generally assume reinvestment of dividends, income and capital gains. Performance of indices may be more or less volatile than any investment strategy.

Performance results for Breckinridge’s investment strategies include the reinvestment of interest and any other earnings, but do not reflect any brokerage or trading costs a client would have paid. Results may not reflect the impact that any material market or economic factors would have had on the accounts during the time period. Due to differences in client restrictions, objectives, cash flows, and other such factors, individual client account performance may differ substantially from the performance presented.

All investments involve risk, including loss of principal. Diversification cannot assure a profit or protect against loss. Fixed income investments have varying degrees of credit risk, interest rate risk, default risk, and prepayment and extension risk. In general, bond prices rise when interest rates fall and vice versa.

This effect is usually more pronounced for longer-term securities. Income from municipal bonds can be declared taxable because of unfavorable changes in tax laws, adverse interpretations by the IRS or state tax authorities, or noncompliant conduct of a bond issuer.

The effectiveness of any tax management strategy is largely dependent on each investor’s entire tax and investment profile, including investments made outside of Breckinridge’s advisory services. As such, there is a risk that the strategy used to reduce the tax liability of the investor is not the most effective for that investor. Breckinridge is not a tax advisor and does not provide personal tax advice. Investors should consult with their tax professionals regarding tax strategies and associated consequences.

Federal and local tax laws can change at any time. These changes can impact tax consequences for investors, who should consult with a tax professional before making any decisions. Further, the Internal Revenue Service (IRS) and other taxing authorities have set certain limitations and restrictions on tax loss harvesting. The tax consequences of Breckinridge’s tax loss strategy may be challenged by the IRS. Investors should consult with their tax professionals regarding tax loss harvesting strategies and associated consequences.

Tax loss harvesting may generate a higher number of trades in an account due to our attempt to capture losses. This can mean higher overall transaction costs to clients. To the extent that a client's custodian uses a different pricing source, cost basis or tax lot accounting, actual tax efficiencies could be greater or lower than what has been shown. Also, a client may repurchase a bond at a higher or lower price than the price at which the original bond was sold. The replacement bond is subject to price fluctuations.

Cross transactions will be used to facilitate tax loss harvesting in most cases. When using cross transactions for tax loss harvesting, participating client accounts gain exposure to the tax-loss harvested bonds received from other accounts. While Breckinridge generally selects bonds that, in its best judgement, will not change significantly in price, bonds nevertheless are subject to fluctuations in price, and the bonds received may go up or down in value.

Cross trades create a conflict as the adviser is advising clients on both sides of the transaction. Also, cross trades can result in more favorable treatment to one client over the other. There is no guarantee that the buying or selling client will receive the best prices available for the day.

Separate accounts may not be suitable for all investors.

Breckinridge believes the data provided by unaffiliated third parties to be reliable but investors should conduct their own independent verification prior to use. Some economic and market conditions contained herein have been obtained from published sources and/or prepared by third parties, and in certain cases have not been updated through the date hereof. All information contained herein is subject to revision.

Certain third parties require us to include the following language when using their information:

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg does not approve or endorse this material or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.