Municipal

Perspective published on November 19, 2025

SMAs: Unlocking Value in Municipal Bond Markets

Summary

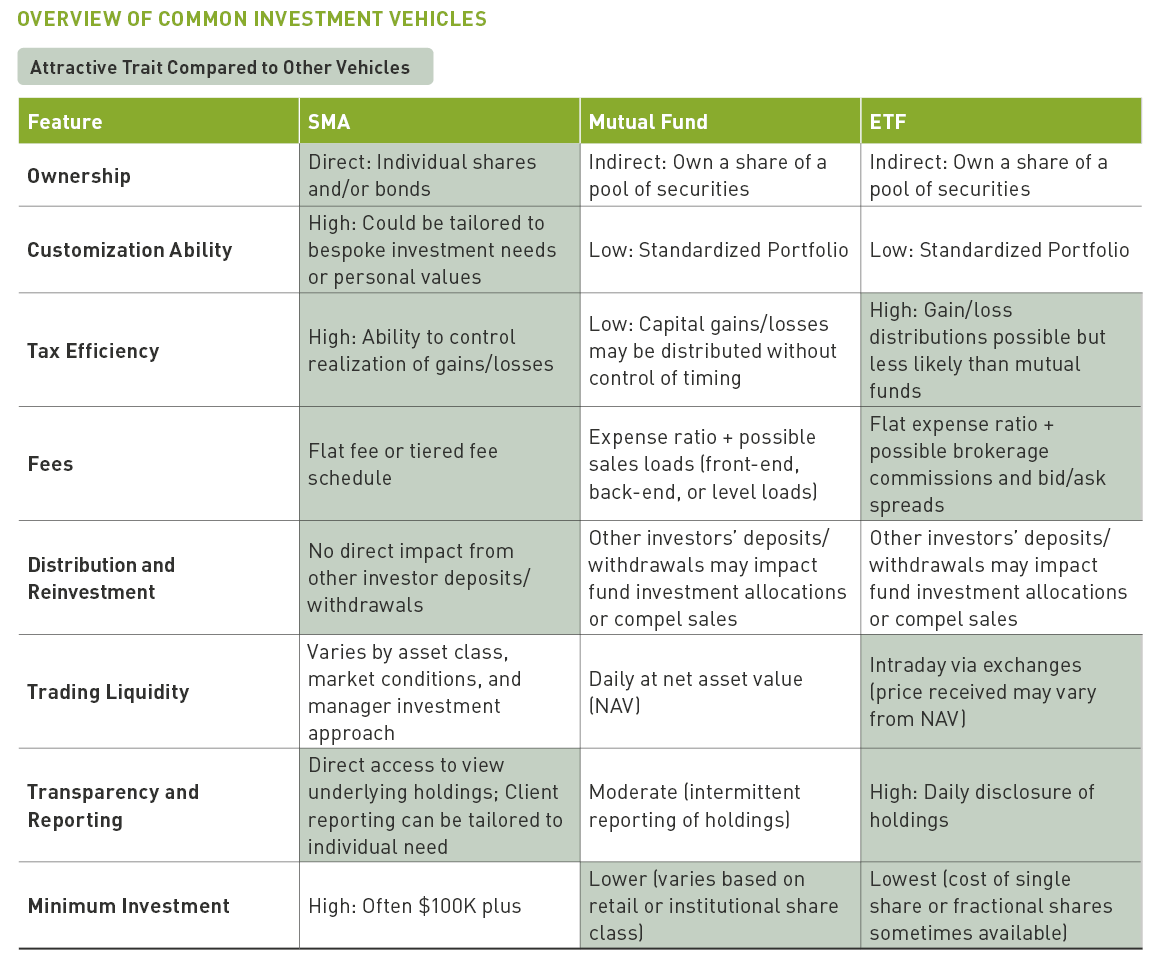

- Today’s investors have access to a wide variety of investment vehicles, often utilizing multiple structures within the same portfolio.

- For municipal bond investors, separately managed accounts (SMAs) remain well-suited to provide transparency, risk management, and tax efficiency.

- The structural advantages of SMAs compared to exchange-traded Funds (ETFs) are particularly evident in portfolio construction and trading during periods of market stress.

The Key Thread: Matching the Vehicle to the Client

As a financial advisor, one of your most valuable skills is helping clients navigate the complex landscape of investment vehicles. While ETFs have grown in popularity due to their simplicity and liquidity over mutual funds, SMAs remain a powerful and often underutilized vehicle for investors in municipal bonds.

When tax efficiency, transparency, and risk management are top priorities, SMAs offer several structural advantages over ETFs, which are especially pronounced during periods of market stress. ETFs and SMAs can offer ease of access, diversification, and tactical exposure across assets. For clients focused on after-tax outcomes, SMAs may also offer customized risk management, as well as greater control and personalization.

Municipal bond SMAs are not just an alternative to ETFs. We see them as a strategic upgrade for the right client. With increased ability for tax management, customization, transparency, and resilience during market dislocations, we believe SMAs allow advisors to deliver significant added value to their clients.

SMAs Can Offer Several Benefits:

1) Transparency and Direct Ownership: Clarity you can communicate

Clients want to understand what they own and SMAs provide full transparency. Portfolio positions are visible and attributable. This makes it easier for advisors to explain holdings, discuss credit quality, and ensure alignment with client values or sustainability preferences.

In an ETF, investors hold fund shares representing proportional interest in the portfolio of assets, rather than the underlying bonds. This layer of abstraction can limit visibility and control, especially when clients want to dig deeper into their exposure.

2) Customization and Control: Building bespoke portfolios to meet client objectives

SMAs provide flexibility. Advisors can work with portfolio managers to tailor a portfolio that matches desired duration, credit quality, and income needs, as well as incorporate targeted state-level exposures to align with client-specific tax considerations. As client needs evolve, a municipal bond SMA can use coupon payments and maturing bonds to shift the portfolio toward new objectives over time.

ETFs, by contrast, provide a one-size-fits-most approach, prioritizing broad market exposure and the most liquid issuers, which may or may not closely track a passive index with no room for individualization. This may be seen as adequate for small accounts or those looking for tactical allocations to an asset class, but it may fall short for clients who have more nuanced needs.

3) Tax efficiency and tax-loss harvesting: Precision at the lot level

Tax-aware investing is always important, and SMAs can offer advisors a powerful tool in this space. Because the investor owns the bonds directly, SMA managers can strategically realize losses at the individual security level. This offers the opportunity to actively manage your client’s tax liability and offset gains elsewhere in the portfolio, while reinvesting proceeds into a new security.

On the one hand, ETF investors are at the mercy of the fund’s internal trading activity and any tax-focused philosophy of the portfolio managers. ETF portfolio managers will typically structure their strategies with the desire to avoid distributing taxable gains to investors, but the ultimate timing and amount of gain realized is outside of the individual investor’s purview.

On the other hand, SMA managers are positioned to respond to changes in a client’s tax situation. For example, a client moving from New York to California may need to reallocate a New York state-focused municipal portfolio to a strategy with more in-state California exposure. A client invested through an SMA can create a customized plan to manage the transition over time and limit turnover and overall tax impact. In years that a client is anticipating a significant taxable event, an SMA manager could potentially be more aggressive in sourcing tax losses to offset some of the external tax liability.

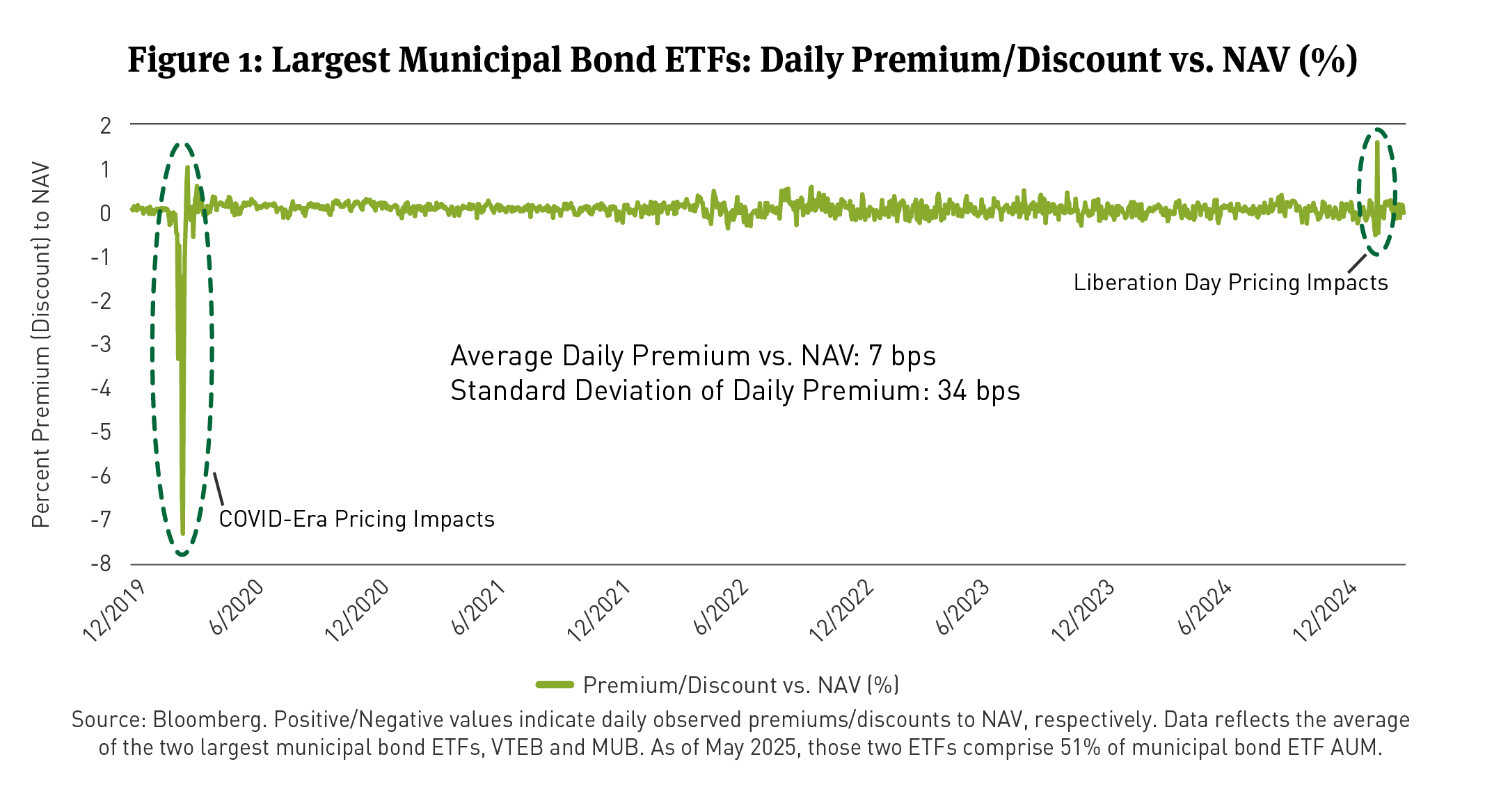

Market Stress and NAV Dislocation: A hidden risk in ETFs

The potential impact of price dislocations during periods of market turmoil is an often-overlooked risk in ETFs. The municipal bond market is highly fragmented and can become relatively illiquid from time to time. Therefore, ETFs can be prone to trading at significant discounts or premiums to their NAV (See Figure 1).

We looked back at two recent periods of high volatility in the municipal market: the tariff announcements during April 2025 “Liberation Day” and the onset of the COVID pandemic in 2020. As the chart illustrates, ETFs prices sometimes varied by hundreds of basis points (bps) from the underlying value of the bonds they held. These NAV deviations reflected the market’s inability to efficiently price the underlying municipal assets in real-time, presenting short-term structural and liquidity-related risk. These dislocations contribute to increased tracking error relative to an ETF’s benchmark, distortion in attribution (i.e. challenges in determining whether returns are derived from fund structure or portfolio construction), and execution mismatches where an investor pays or receives a price inconsistent with NAV.

SMAs, in contrast, may be insulated from these distortions by providing investors with direct ownership of securities whose prices reflect their true market value, even during periods of volatility; this prevents them from being influenced by the premiums or discounts driven by the actions of other investors following the same strategy. Investors retain the option to simply maintain their holdings through a volatile period, choose to selectively trade on fundamental value, or to concertedly realize tax losses, rather than being susceptible to the whim of market sentiment. While over the long-run, ETF share prices will typically average near their respective NAVs, the risk of short-term dislocations triggered by other investors in the vehicle remain.

Strategic Advantage for SMAs: Opportunistic participation in volatile markets

In an era where investors can execute buys and sells almost instantaneously, it has never been easier to make abrupt or even impulsive trading decisions. In aggregate, this creates a market environment where ETFs must absorb flows, even if fully outside of the manager’s control or, potentially not reflective of security fundamentals.

In periods of market disarray, absent adequate cash to meet redemptions, ETF managers may be forced to turn to the market and sell holdings to raise cash. While ETF managers may be influenced by the power of asset flows when navigating volatile, SMA managers are poised to take advantage of the market mispricing, opportunistically trading when they perceive value in bonds that are out for bid. Often, managers of collective funds like ETFs may favor selling bonds with shorter duration and higher credit quality because those bonds are likely to prove the easiest to sell in times of market stress. SMA managers, on the other hand, may add these assets to their accounts at favorable prices that offer higher potential for incremental gains in future transactions.

This dynamic creates a natural opportunity for high-quality municipal SMA managers to pounce on the opportunity, offer liquidity to the market, and benefit from investor behavior within ETFs. In particular, managers who use algorithmic trading are positioned to quickly identify and capitalize on mispriced securities available in dealer inventory. During periods of high market volatility, ETF managers may have to make trades that affect all investors in the fund simply to raise cash for a limited number of investors. SMA managers may be able to prudently hold positions on behalf of each investor, without ripple effects spilling over to other investors.

Conclusion: How you invest matters

At Breckinridge, we believe that income-oriented investors are better served by owning a portfolio of individual securities directly. The benefits of SMAs, including transparency, customization, and the ability to harvest tax losses at the individual security level, can make them an attractive option for investors with nuanced needs.

Our SMA clients also have significant flexibility to customize portfolio parameters. Breckinridge collaborates with advisors extensively to determine how we can aim to achieve our clients’ needs, working with clients and their advisors and consultants to customize portfolios to appropriately align with each client’s objectives, risk tolerances, income objectives and liquidity requirements. While ETFs provide simplicity and liquidity, SMAs may be better suited to meet the changing needs of individual investors, especially during periods of market stress, when the ability to manage risk and capitalize on market dislocations becomes particularly valuable.

BCAI-11132025-k7awzzcx (11/17/2025)

DISCLAIMERS:

The content is intended for investment professionals and institutional investors.

This material provides general and/or educational information and should not be construed as a solicitation or offer of Breckinridge services or products or as legal, tax or investment advice. The content is current as of the time of writing or as designated within the material. All information, including the opinions and views of Breckinridge, is subject to change without notice.

There is no assurance that any estimate, target, projection or forward-looking statement (collectively, “estimates”) included in this material will be accurate or prove to be profitable; actual results may differ substantially. Breckinridge estimates are based on Breckinridge’s research, analysis and assumptions. Other events that were not considered in formulating such projections could occur and may significantly affect the outcome, returns or performance.

Past performance is not a guarantee of future results. Breckinridge makes no assurances, warranties or representations that any strategies described herein will meet their investment objectives or incur any profits. Any index results shown are for illustrative purposes and do not represent the performance of any specific investment. Indices are unmanaged and investors cannot directly invest in them. They do not reflect any management, custody, transaction or other expenses, and generally assume reinvestment of dividends, income and capital gains. Performance of indices may be more or less volatile than any investment strategy.

Performance results for Breckinridge’s investment strategies include the reinvestment of interest and any other earnings, but do not reflect any brokerage or trading costs a client would have paid. Results may not reflect the impact that any material market or economic factors would have had on the accounts during the time period. Due to differences in client restrictions, objectives, cash flows, and other such factors, individual client account performance may differ substantially from the performance presented.

All investments involve risk, including loss of principal. Diversification cannot assure a profit or protect against loss. Fixed income investments have varying degrees of credit risk, interest rate risk, default risk, and prepayment and extension risk. In general, bond prices rise when interest rates fall and vice versa.

This effect is usually more pronounced for longer-term securities. Income from municipal bonds can be declared taxable because of unfavorable changes in tax laws, adverse interpretations by the IRS or state tax authorities, or noncompliant conduct of a bond issuer.

The effectiveness of any tax management strategy is largely dependent on each investor’s entire tax and investment profile, including investments made outside of Breckinridge’s advisory services. As such, there is a risk that the strategy used to reduce the tax liability of the investor is not the most effective for that investor. Breckinridge is not a tax advisor and does not provide personal tax advice. Investors should consult with their tax professionals regarding tax strategies and associated consequences.

Federal and local tax laws can change at any time. These changes can impact tax consequences for investors, who should consult with a tax professional before making any decisions. Further, the Internal Revenue Service (IRS) and other taxing authorities have set certain limitations and restrictions on tax loss harvesting. The tax consequences of Breckinridge’s tax loss strategy may be challenged by the IRS. Investors should consult with their tax professionals regarding tax loss harvesting strategies and associated consequences.

Tax loss harvesting may generate a higher number of trades in an account due to our attempt to capture losses. This can mean higher overall transaction costs to clients. To the extent that a client's custodian uses a different pricing source, cost basis or tax lot accounting, actual tax efficiencies could be greater or lower than what has been shown. Also, a client may repurchase a bond at a higher or lower price than the price at which the original bond was sold. The replacement bond is subject to price fluctuations.

Cross transactions will be used to facilitate tax loss harvesting in most cases. When using cross transactions for tax loss harvesting, participating client accounts gain exposure to the tax-loss harvested bonds received from other accounts. While Breckinridge generally selects bonds that, in its best judgement, will not change significantly in price, bonds nevertheless are subject to fluctuations in price, and the bonds received may go up or down in value.

Cross trades create a conflict as the adviser is advising clients on both sides of the transaction. Also, cross trades can result in more favorable treatment to one client over the other. There is no guarantee that the buying or selling client will receive the best prices available for the day.

Separate accounts may not be suitable for all investors.

Breckinridge believes the data provided by unaffiliated third parties to be reliable but investors should conduct their own independent verification prior to use. Some economic and market conditions contained herein have been obtained from published sources and/or prepared by third parties, and in certain cases have not been updated through the date hereof. All information contained herein is subject to revision.

Certain third parties require us to include the following language when using their information:

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg does not approve or endorse this material or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.