Investing

Perspective published on September 12, 2025

Public Investment Grade Debt and Private Credit are Friends, Not Foes

Summary

- Private credit allocations have progressed from niche to mainstream, presenting investors with two critical considerations.

- First: You must get your private credit allocations right. Success in markets that are more complex and less transparent requires intense focus.

- Second: You cannot overlook your public market investments. Underestimating the value of or oversimplifying investment grade fixed income strategies can be a disservice to reaching a well-balanced portfolio’s strategic objectives.

- Breckinridge manages fixed income portfolios that tend to counterbalance riskier assets in periods of economic distress and uncertainty, when consistent income and capital preservation typically matter most, while complementing private credit allocations across different market regimes.

In this article, we discuss the opportunities and challenges associated with building well-balanced portfolios of private credit investments and fixed income investments available in public markets.

Exploring the opportunities and challenges of private credit investing

Private credit allocations can be significant contributors to investment portfolio total returns. They have the potential to enhance diversification, to provide differentiated return streams, and to have low correlation to traditional bond investments. In a diversified portfolio, private credit can lead to potentially lower volatility compared to portfolios comprised only of publicly traded bonds.

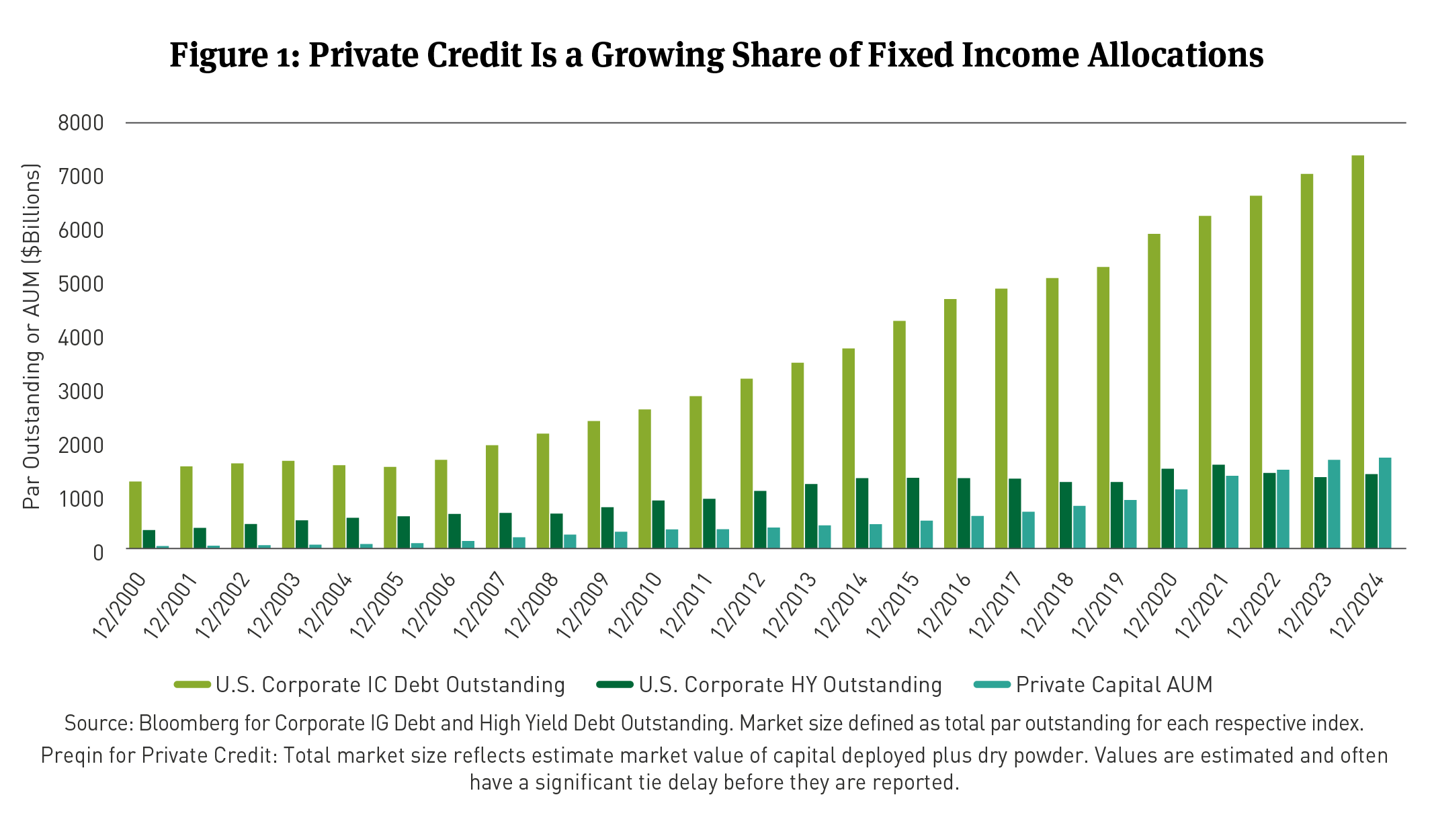

The growth of private credit issuance since 2000 helps to illustrate its increasing acceptance and presence among fixed income investors (See Figure 1). In 2022, total private credit assets under management surpassed high yield credit issuance for the first time and private credit continues to represent a growing portion of overall fixed income portfolio allocations.

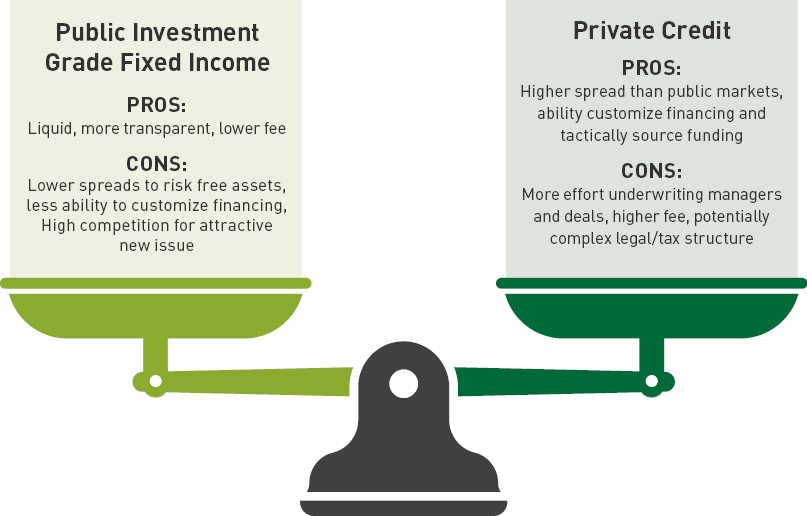

Managing private credit investments also can present higher risks and demand more time and attention. Private credit is inherently more complex and less transparent than public market investment grade bonds. For example, private credit instruments may be priced less frequently. Issuers may have lower credit ratings or be more highly leveraged. Investors may need to assess a wider range of financing structures, and liquidity premiums can be difficult to measure.

In addition, because meaningful differences in managers’ skill and experience can lead to dispersion of returns, success in capturing alpha relies upon the ability of investors, asset allocators, consultants, investment committees, and chief investment officers to identify and source top-performing private credit managers.

Seeking balance among private credit and public investment grade bond investments

Because private credit allocations can command more time and attention, Breckinridge recognizes that it makes perfect sense to budget a greater time, energy and resources to private credit allocations relative to public market exposures.

At the same time, decision makers who reduce the time and attention dedicated to investment grade fixed income allocations may risk outcomes contrary to their overall portfolio objectives. For example, choosing to limit public bond investments (i.e. capital preservation, liability hedging) can also impede exposures to the return seeking potential of higher risk market segments. Similarly, indexing fixed income investments may limit opportunities for active managers to capture alpha that public markets can offer.

On the other hand, return expectations for publicly offered bonds are more modest relative to private credit historically. An aggressive investment grade fixed income risk budget that attempts to extract marginal incremental excess returns through exposures to sectors with elevated risk profiles may lead to negative excess returns and illiquidity. This portfolio outcome can be particularly damaging if it occurs when the historical resilience and liquidity of high-quality fixed income investments may have helped sustain overall portfolio performance.

Selecting the right approach (and manager) for investment grade fixed income assets

Underestimating the value of or oversimplifying approaches to complementing private credit allocations with public market investment grade bonds can be a disservice to the performance of a well-balanced portfolio against strategic objectives.

As an investment manager specializing in investment grade fixed income, Breckinridge prefers to construct resilient, high quality bond portfolios that provide stability to enable our clients and their consultants to more confidently consider private credit, where expected excess returns may be greater.

Our approach is intentionally balanced. We aim to incrementally enhance income while emphasizing high credit quality and disciplined duration management. The Breckinridge Investment Committee evaluates yield curve, sector spreads, credit markets and supply/demand dynamics to balance total return and yield considerations and inform portfolio structure.

Breckinridge recognizes the significant role that private credit can play within overall portfolio allocations. We also believe in the value of a well-structured, high quality fixed income portfolio as a crucial counterbalance, as investors and their consultants weigh the risks of private credit allocations.

BCAI-09082025-lgrlruxb (9/9/2025)

DISCLAIMERS:

The content is intended for investment professionals and institutional investors.

This material provides general information and should not be construed as a solicitation or offer of services or products or as legal, tax or investment advice. Nothing contained herein should be considered a guide to security selection, asset allocation or portfolio construction.

All information and opinions are current as of the dates indicated and are subject to change. Breckinridge believes the data provided by unaffiliated third parties to be reliable, but investors should conduct their own independent verification prior to use. Some economic and market conditions contained herein have been obtained from published sources and/or prepared by third parties, and in certain cases have not been updated through the date hereof.

There is no assurance that any estimate, target, projection or forward-looking statement (collectively, “estimates”) included in this material will be accurate or prove to be profitable; actual results may differ substantially. Breckinridge estimates are based on Breckinridge’s research, analysis and assumptions. Other events that were not considered in formulating such projections could occur and may significantly affect the outcome, returns or performance.

Not all securities or issuers mentioned represent holdings in client portfolios. Some securities have been provided for illustrative purposes only and should not be construed as investment recommendations. Any illustrative engagement or sustainability analysis examples are intended to demonstrate Breckinridge’s research and investment process.

Yields and other characteristics are metrics that can help investors in valuing security, portfolio or composite. Yields do not represent performance results, but they are one of several components that contribute to the return of a security, portfolio or composite. Yields and other characteristics are presented gross of advisory fees.

All investments involve risk, including loss of principal. No investment or risk management strategy, including diversification, can guarantee positive results or risk elimination in any market. Periods of elevated market volatility can significantly impact the value of securities. Investors should consult with their advisors to understand how these risks may affect their portfolios and to develop a strategy that aligns with their financial goals and risk tolerances.

Past performance is not indicative of future results. Breckinridge makes no assurances, warranties or representations that any strategies described herein will meet their investment objectives or incur any profits. Performance results for Breckinridge’s investment strategies include the reinvestment of interest and any other earnings, but do not reflect any brokerage or trading costs a client would have paid. Results may not reflect the impact that any material market or economic factors would have had on the accounts during the period. Due to differences in client restrictions, objectives, cash flows, and other such factors, individual client account performance may differ substantially from the performance presented.

Actual client advisory fees may differ from the advisory fee used to calculate net performance results. Client returns will be reduced by the advisory fees and any other expenses incurred in the management of their accounts. For example, an advisory fee of 1 percent compounded over a 10-year period would reduce a 10 percent return to a 9 percent annual return. Additional information on fees can be found in Breckinridge’s Form ADV Part 2A.

Index results are shown for illustrative purposes and do not represent the performance of any specific investment. Indices are unmanaged and investors cannot directly invest in them. They do not reflect management, custody, transaction or other expenses, and generally assume reinvestment of dividends, income and capital gains. Performance of indices may be more or less volatile than any investment strategy.

There is no guarantee that the strategies or approaches discussed will achieve their objectives, lower volatility or be profitable. All investments involve risk, including loss of principal. Diversification cannot assure profit or protect against loss. No investment or risk management strategy can guarantee positive results or risk elimination in any market.

Fixed income investments have varying degrees of credit risk, interest rate risk, default risk, and prepayment and extension risk. In general, bond prices rise when interest rates fall and vice versa.

Equity investments are volatile and can decline significantly in response to investor reception of the issuer, market, economic, industry, political, regulatory or other conditions.

When integrating sustainability analysis with traditional financial analysis, Breckinridge’s investment team will consider material sustainability factors but may conclude that other attributes outweigh the sustainability considerations when making investment decisions.

There is no guarantee that integrating sustainability analyses will improve risk-adjusted returns, lower portfolio volatility over any specific time period, or outperform the broader market or other strategies that do not utilize these analyses when selecting investments. The consideration of sustainability factors may limit investment opportunities available to a portfolio. In addition, data for sustainable factors often lacks standardization, consistency and transparency and for certain companies such data may not be available, complete or accurate.

Breckinridge’s sustainability analysis is based on third party data and Breckinridge analysts’ internal analysis. Analysts will review a variety of sources such as corporate sustainability reports, data subscriptions, and research reports to obtain available metrics for internally developed frameworks. A high sustainability rating does not mean it will be included in a portfolio, nor does it mean that a bond will provide profits or avoid losses.

Investments in thematic customizations will subject the portfolio to proportionately higher risk exposure of any sectors or regions in which the investments target. In addition, the investments held in thematic customizations may not meet the desired positive impact or become subject to negative publicity; these types of events may cause the customizations to have poor performance due to the concentration of assets. There is no assurance that customizations or strategies will meet their objectives.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg does not approve or endorse this material or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.