Municipal

Perspective published on November 20, 2025

Meaningful Muni Benefits in No-Income-Tax States

Summary

- Municipal bond investments are mostly — but not entirely — about producing after-tax income.

- Beyond tax-free yield, muni bonds can offer other advantages including tax-hedging, fixed-income diversification, safety, and thematic investing opportunities.

One of the joys of working at Breckinridge is the opportunity to talk with investment advisors and clients across the United States. Depending on an investor’s state of residence, investment needs vary. Most salient for muni investors: Tax rates differ from state to state.

Over the past decade, we’ve noticed that some low-tax bracket Sunbelt state investors now question the value-add of investment grade (IG) municipal bonds. Low-bracket residents of Texas, Florida, Tennessee, Nevada and five other states1 face no state personal income tax. With low Municipal/Treasury (M/T) ratios during much of the past decade,2 the after-tax opportunity in taxable bonds (and/or high-yield munis) has often made better tax sense than an IG muni allocation.

Breckinridge is sympathetic to the approach of investors in low-tax states —but only up to a point. Our portfolio management teams customize accounts for state tax preferences and with after-tax income at top of mind (See Customizing Separate Accounts and In-State and Out-of-State Municipal Bonds: Key Investment Considerations). We acknowledge that, sometimes, the “tax math” doesn’t add up.

However, munis are not solely about producing after-tax income in the here-and-now. Other considerations matter. These include:

1. Munis can be a tax-hedge against higher tax rates tomorrow.

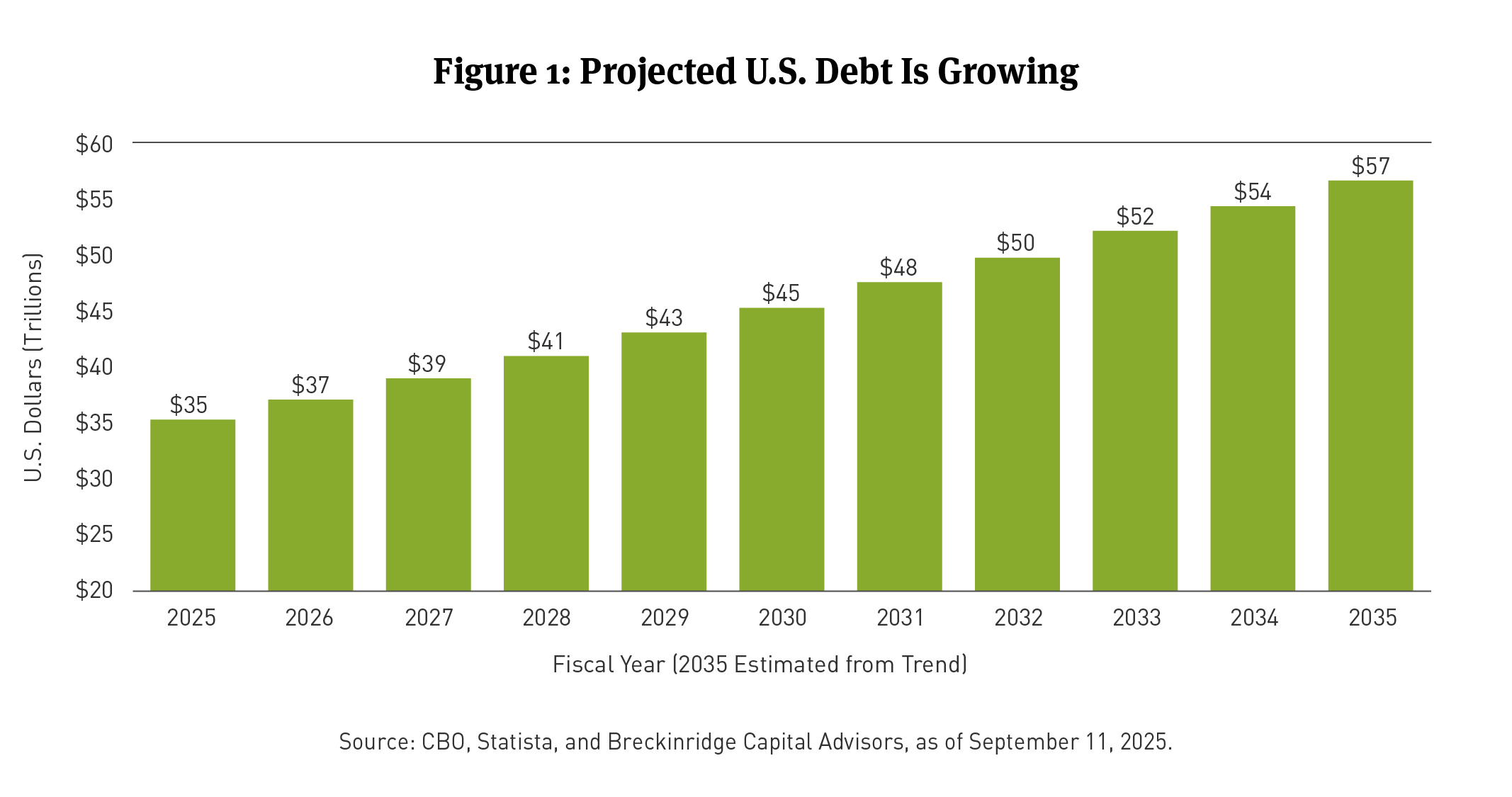

Today’s federal deficits will need to be addressed, eventually. When that happens, federal income tax rates could go up. By 2035, the Congressional Budget Office (CBO) projects that U.S. debt held by the public will reach 118 percent of gross domestic product (GDP), surpassing post-World War II highs (See Figure 1).

2. Tax-efficiency is no longer just about “tax-free” income.

In well-structured separately managed accounts (SMAs), investors can potentially capture the benefits of tax losses through tax-loss harvesting. 2022 provides a unique illustration of the potential benefits of tax-loss harvesting. In 2022, Breckinridge estimates that via tax-loss harvesting trades, an average of 80 basis points (bps) in tax savings was achieved for portfolios (as represented by our Intermediate Tax Efficient composite), as interest rates rose from historic lows.3 Rising rates are challenging from a performance perspective, but the ability to harvest losses can provide investors with a potential tax benefit to offset gains elsewhere in their overall portfolio.

Municipal investors can also opt for “mixed” portfolios in modern SMAs. This involves buying taxable bonds, typically Treasuries, in a traditional muni account, when the after-tax math warrants. “Crossing over” into the highly liquid taxable market empowers an investor to focus on after-tax yields, while preserving the optionality to return to the tax-free market when M/T ratios return to favorable levels.

3. Sector diversification.

Munis offer a high-grade fixed income allocation that is typically less correlated to equities than other fixed income sectors. It’s clear to us that investors in low-tax states understand this reality. We note that some of the zip codes with the highest concentrations of municipal bond ownership are in states without a personal income tax (See Figure 2).

4. Safety.

Many municipal bond investors are retirees interested in protecting a nest egg. Municipal credit quality compares favorably to that found in other fixed income markets, including the corporate bond market (See Figure 3). And unlike the federal government, a heavily indebted standalone entity, the municipal market has deleveraged over the past decade and offers investors a diverse mix of borrowers.

5. Thematic opportunities.

Many municipal investors get a psychological benefit from allocating capital to mission-aligned investments.

For some investors, this means investing in home-state infrastructure projects, targeting or avoiding specific sectors, or understanding transparently the use of proceeds for investments.

Additionally, some investors may choose to target a combination of factors. For example, Breckinridge launched a Climate Vulnerability Customization for tax-efficient portfolios in 2023. This customization empowers investors to direct capital to communities that are both vulnerable to physical climate risk and face resource constraints due to lower income levels or higher infrastructure needs.

6. Relative value.

Market conditions are always changing; however, in the current environment, investors should consider fixed income credit spreads when comparing the muni market to others. In particular, credit spreads in the corporate bond market are near- or at all-time tights, as of October 31, 2025. This suggests there may be more downside risk in buying a corporate security relative to a municipal, even if after-tax yields indicate otherwise.

If you are an advisor or end-client concerned that after-tax yields alone are not sufficiently compelling to invest in municipals, we encourage you to connect with us. There’s more to unpack in municipal bonds than the tax-exemption, alone.

[1] The nine states with no personal income tax as of September 2025 are: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming.

[2] Based on U.S. Department of the Treasury and Municipal Market Data the 10-year AAA municipal bond yield averaged about 80 percent of the comparable Treasury yield from 2015 through September 29, 2025.

[3] 2022 tax-losses are not representative of potential tax-loss benefits in all market environments. Tax loss calculations are based on all portfolios in the Intermediate Tax Efficient composite that have opted into tax-loss harvesting and are calculated as a percentage of portfolio AUM. Tax-losses are harvested when losses in a portfolio reach a level as defined by portfolio management. Any tax losses generated as a result of tax-loss harvesting are potential in nature and do not necessarily guarantee a tax benefit. The GIPS Report for the Intermediate Tax Efficient Composite is available upon request.

BCAI-11142025-nguwk9at (11/19/2025)

DISCLAIMERS:

The content is intended for investment professionals and institutional investors.

This material provides general information and should not be construed as a solicitation or offer of services or products or as legal, tax or investment advice. Nothing contained herein should be considered a guide to security selection, asset allocation or portfolio construction.

All information and opinions are current as of the dates indicated and are subject to change. Breckinridge believes the data provided by unaffiliated third parties to be reliable but investors should conduct their own independent verification prior to use. Some economic and market conditions contained herein have been obtained from published sources and/or prepared by third parties, and in certain cases have not been updated through the date hereof.

There is no assurance that any estimate, target, projection or forward-looking statement (collectively, “estimates”) included in this material will be accurate or prove to be profitable; actual results may differ substantially. Breckinridge estimates are based on Breckinridge’s research, analysis and assumptions. Other events that were not considered in formulating such projections could occur and may significantly affect the outcome, returns or performance.

Not all securities or issuers mentioned represent holdings in client portfolios. Some securities have been provided for illustrative purposes only and should not be construed as investment recommendations. Any illustrative engagement or sustainability analysis examples are intended to demonstrate Breckinridge’s research and investment process.

Yields and other characteristics are metrics that can help investors in valuing a security, portfolio or composite. Yields do not represent performance results but they are one of several components that contribute to the return of a security, portfolio or composite. Yields and other characteristics are presented gross of advisory fees.

All investments involve risk, including loss of principal. No investment or risk management strategy, including diversification, can guarantee positive results or risk elimination in any market. Periods of elevated market volatility can significantly impact the value of securities. Investors should consult with their advisors to understand how these risks may affect their portfolios and to develop a strategy that aligns with their financial goals and risk tolerances.

Past performance is not indicative of future results. Breckinridge makes no assurances, warranties or representations that any strategies described herein will meet their investment objectives or incur any profits. Performance results for Breckinridge’s investment strategies include the reinvestment of interest and any other earnings, but do not reflect any brokerage or trading costs a client would have paid. Results may not reflect the impact that any material market or economic factors would have had on the accounts during the time period. Due to differences in client restrictions, objectives, cash flows, and other such factors, individual client account performance may differ substantially from the performance presented.

Fixed income investments have varying degrees of credit risk, interest rate risk, default risk, and prepayment and extension risk. In general, bond prices rise when interest rates fall and vice versa.

Tax Management Considerations:

The effectiveness of a tax loss harvesting strategy is largely dependent on each client’s entire tax and investment profile, including investments made outside of Breckinridge’s advisory services. As such, there is a risk that the strategy used to reduce the tax liability of the client is not the most effective for every client. To the extent that a client’s custodian uses a different cost basis or tax lot accounting, tax efficiencies may be greater or lower than Breckinridge’s estimates. Tax loss harvesting may generate a higher number of trades in an account due to our attempt to capture losses.

This can mean higher overall transaction costs to clients. Further, a client account may repurchase a bond at a higher or lower price than the price at which the original bond was sold. Cross transactions will be used to facilitate tax loss harvesting in most cases. When using cross transactions for tax loss harvesting, participating client accounts gain exposure to the tax-loss harvested bonds received from other accounts. While Breckinridge generally selects bonds that, in its best judgement, will not change significantly in price, bonds nevertheless are subject to fluctuations in price, and the bonds received may go up or down in value. Federal and local tax laws and rates can change at any time; changes to tax laws and rates can impact tax consequences for clients. Further, the Internal Revenue Service (IRS) and other taxing authorities have set certain limitations and restrictions on tax loss harvesting. The tax consequences of Breckinridge’s tax loss strategy may be challenged by the Internal Revenue Service.

Breckinridge is not a tax advisor and does not provide personal tax advice. Clients should consult with their tax professionals regarding tax loss harvesting strategies and associated consequences.