Corporate

Commentary published on April 5, 2023

Q2 2023 Corporate Bond Market Outlook

Summary

- Banking sector concerns in the U.S. that emerged late in the quarter overwhelmed expectations shaped during the prior 10 weeks of the quarter, with implications for future monetary policy and Federal Reserve (Fed) efforts to reduce inflation.

- The Federal Deposit Insurance Corporate (FDIC) assumed control of two mid-sized U.S. regional banks in March, as depositor withdrawals overwhelmed the banks’ liquidity positions.

- Analysis of the two banks’ capital assets indicated that, at least at a high level, as deposit withdrawals spiraled, long-term holdings were mismatched with short-term cash demands.

- At its March meeting, the Fed announced a 25 basis points (bps) increase in the federal funds rate, stating “inflation remains elevated” and removing the phrase, “inflation has eased somewhat,” which appeared in its February statement.

- Fed Chairman Jay Powell also said, “The U.S. banking system is sound and resilient,” while acknowledging that the Banking sector concerns are “likely to result in tighter credit conditions” and “weigh on economic activity, hiring and inflation,” in effect supporting Fed efforts.

- Looking ahead, our negative view of fundamental credit conditions in the Banking sector is balanced by sector valuations that are 22bps wide to the IG Corporate Index and about 2½ years shorter in duration.

Investment Review and Outlook

Banking concerns contributed to volatility, as the Fed kept upward pressure on interest rates.

Entering 2023, the Fed campaign to arrest inflation included eight increases to the fed funds rate totaling 450bps. In addition, beginning in June 2022, the Fed stopped reinvesting proceeds of maturing Treasury and agency mortgage-backed securities (MBS) each month, reversing the quantitative easing (QE) program that it initiated to support risk asset prices during the COVID-19 pandemic-induced economic slowdown.

At times, contradictory economic data indicated overall that inflation was moderating through January and February. Higher interest rates were suppressing housing activity and inflation measures like the personal consumption expenditures index retreated somewhat from the high increases seen in 2022. In contrast, the continued tight labor market sustained upward pressure on wages and favorable consumer sentiment.

As the Fed pursued its efforts to address inflation, investment markets were relatively strong with the Standard & Poor’s 500 Index (S&P 500 Index)1 up 5.4 percent through March 3 and the Bloomberg (BBG) Corporate Investment Grade (IG) Bond Index (the Corporate Index)2 up 0.91 percent.

The Federal Deposit Insurance Corporation (FDIC) assumed responsibility for operations at Silicon Valley Bank (SIVB) and Signature Bank of New York (SBNY) upon their failure on Friday, March 10, and Sunday, March 12, respectively. The failure of SVB sparked concerns over uninsured deposits and potential liquidity issues at other regional banks. Banks were already tightening standards prior to this shock.3

Rapid Fed funds interest rate hikes, quantitative tightening (QT), regulations requiring minimum levels of high-quality liquid assets (HQLA), reduced reserves and tightened liquidity drove higher levels of unrealized losses across Treasury bond and MBS portfolios held in bank securities portfolios.

As investor concerns increased about the potential for widespread weakness in the financial sector, the S&P 500 fell 4.6 percent and the Corporate Index was off 1.5 percent for the week ended March 10, based on BBG data. Both indexes turned quickly, delivering positive results during the last two weeks of the month. At the end of the first quarter (1Q), the S&P 500 returned 7.0 percent and the Corporate Index gained 3.5 percent.

Despite Banking sector issues, the Fed prioritized efforts to reduce inflation by raising the fed funds rate 25bps at its meeting on March 21 and 22 to a range of 4.75 percent to 5 percent, with a projected rate of 5.1 percent by year end.

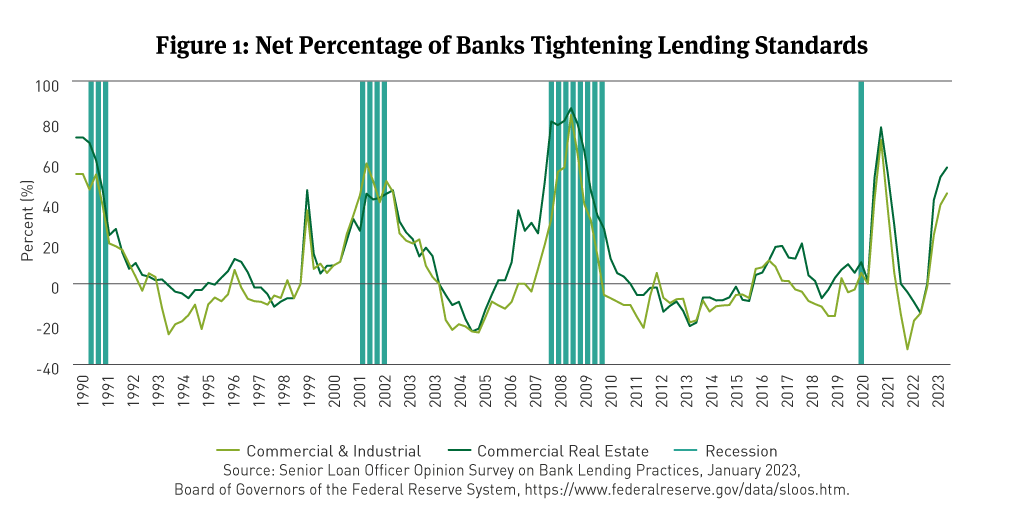

Chairman Powell suggested “some additional policy firming may be needed” but also acknowledged that the bank issues were likely to further tighten lending conditions (See Figure 1), which naturally limits capital in circulation and thus, creates additional tightening. The Fed also revised its gross domestic product (GDP) growth forecasts downward 0.4 percent in 2023, bigger drop for 2024, 1.2 from 1.6 percent).

In our view, until the Government and financial regulators restore full confidence in the U.S. banking system, issuers will be focused primarily on their own balance sheets, shoring up liquidity, and considering capital raises when the market settles down. Controllable lending activity from the Banking sector likely will slow materially, impacting credit creation and economic growth.

Fundamentals

As Unrealized Bond Losses Grow Relative To Equity Capital, Bank Credit Fundamentals May Weaken

As the Fed moved interest rates off the zero-bound to 5 percent, banks’ unrealized bond losses grew during 2022 (See Figure 2). Unrealized losses were about 13 percent of bank equity capital at year-end (YE) 2022.

Unrealized losses in available-for-sale (AFS) securities are reported in a bank’s accumulated other comprehensive income (AOCI), which is included as a contra account in shareholders’ equity.

Hold-to-maturity (HTM) securities are held at amortized costs and are not included in AOCI. Twenty-five large U.S. banks had HTM unrealized losses of 12 percent of bank equity capital at YE22.

Bank deposits grew strongly during the Fed’s quantitative easing, expanding from $8.6 trillion in 2008 to a peak of $19.9 trillion at the end of 2021. Bank deposits declined by $718 billion in 2022.

For the latest period, 45 percent of senior loan officers reported their banks had increased loan rates or spreads over their costs of funds driving a tightening and increase in the cost of credit.

The pace of tightening and increase in the cost of credit may accelerate further in April, as the cost of bank funding has risen. If loan spreads rise further, they may approach recessionary levels.

Through January, 47 percent of senior loan officers reported their banks had increased the premiums charged on riskier loans while just 7 percent reported an easing in standards.

While senior loan officers are noting tightened lending standards across commercial and industrial (C&I) and commercial real estate (CRE) loans, tightening across consumer and mortgage loans is somewhat less although directionally similar.

Technicals

Corporate Supply Decreased, as Interest Rates and Volatility Increased

IG new issuance for 1Q23 was about $403 billion as compared to $472 billion the prior year (See Figure 4). Issuance during the quarter was stymied by market volatility in March, which was “only” a $100-billion month.

IG fund flows, per Emerging Portfolio Fund Research, were $3 billion in March, a downshift from about $32 billion of inflows in February and $30 billion in January. Intermediate term bond funds have brought in about 85 percent of net flows year-to-date (YTD).

With yields still relatively high on the IG Corporate Index (5.25 percent at 1Q23, per BBG), we would expect further rotation into fixed income by institutions acting as a tailwind for the IG market.

Valuations

Credit Curves Flatten as Spreads Widen Most in the Front End

IG corporate spreads widened 8bps in 1Q23, finishing the quarter at 138bps. In an unusual occurrence, spreads for bonds rated A and BBB both widened 9bps, with bonds rated A slightly outperforming in March.

Credit curve flattening was particularly noteworthy during the quarter with 1- to 5-year maturity bond spreads gapping out 20bps while 7- to 10-year corporate bond spreads were 4bps tighter in 1Q 2023 (See Figure 5).

The sharp flattening and move wider in shorter-maturity spreads created some opportunities during the quarter, particularly in higher-quality issuers that recently issued new corporate bonds.

ESG Spotlight

In March, the UN Intergovernmental Panel on Climate Change (IPCC) released its latest report. It found current emissions reduction targets were insufficient to prevent the worst effects of climate change. As such, environmental risks will continue to represent a significant environmental, social and governance (ESG) investment considerations across sectors and geographies.

Breckinridge published its 2022 ESG Issuer Engagement report Wider Engagement Lens Deepens Examination of Material ESG Risks. During 2022, our corporate and municipal bond research team members held 131 direct engagement discussions with issuers and subject matter experts (SMEs) in 12 sectors across bond markets. Our engagement meetings were in addition to numerous interactions our analysts routinely have with issuers and SMEs in the conduct of new security research and ongoing bond surveillance, including regular quarterly earnings calls.

The CFA Institute issued the first global voluntary standards for disclosing how an investment product considers environmental, social and governance (ESG) issues in November 2021. The Standards are intended as ethical principles for the fair representation and full disclosure of an investment product’s ESG approaches. Breckinridge is developing its disclosures in compliance with the standards, with support from the CFA institute, with the goal of finalizing them in 2023.

[1] The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. Itis a market-value-weighted index with each stock’s weight in the index proportionate to its market value. You cannot invest directly in an index.

[2] The Bloomberg U.S. Corporate Bond Index is an unmanaged market-value-weighted index of investment-grade corporate fixed-rate debt issues with maturities of one year or more. You cannot invest directly in an index.

[3] The FDIC, appointed as receiver, closed SVB on March 10, 2023, and created a bridge bank to protect insured depositors. Initially, uninsured depositors were not described in the same manner. Concerns over uninsured deposits in the banking system sparked volatility, particularly in regional banks. On March 13, 2023, the FDIC clarified that all depositors would have full access to their money. Breckinridge did not hold SVB bonds. https://www.fdic.gov/news/press-releases/2023/pr23016.html, https://www.fdic.gov/news/press-releases/2023/pr23019.html

Disclosures:

This material provides general and/or educational information and should not be construed as a solicitation or offer of Breckinridge services or products or as legal, tax or investment advice. The content is current as of the time of writing or as designated within the material. All information, including the opinions and views of Breckinridge, is subject to change without notice.

Any estimates, targets, and projections are based on Breckinridge research, analysis, and assumptions. No assurances can be made that any such estimate, target or projection will be accurate; actual results may differ substantially.

Past performance is not a guarantee of future results. Breckinridge makes no assurances, warranties or representations that any strategies described herein will meet their investment objectives or incur any profits. Any index results shown are for illustrative purposes and do not represent the performance of any specific investment. Indices are unmanaged and investors cannot directly invest in them. They do not reflect any management, custody, transaction or other expenses, and generally assume reinvestment of dividends, income and capital gains. Performance of indices may be more or less volatile than any investment strategy.

Performance results for Breckinridge’s investment strategies include the reinvestment of interest and any other earnings, but do not reflect any brokerage or trading costs a client would have paid. Results may not reflect the impact that any material market or economic factors would have had on the accounts during the time period. Due to differences in client restrictions, objectives, cash flows, and other such factors, individual client account performance may differ substantially from the performance presented.

All investments involve risk, including loss of principal. Diversification cannot assure a profit or protect against loss. Fixed income investments have varying degrees of credit risk, interest rate risk, default risk, and prepayment and extension risk. In general, bond prices rise when interest rates fall and vice versa. This effect is usually more pronounced for longer-term securities. Income from municipal bonds can be declared taxable because of unfavorable changes in tax laws, adverse interpretations by the IRS or state tax authorities, or noncompliant conduct of a bond issuer.

Breckinridge believes that the assessment of ESG risks, including those associated with climate change, can improve overall risk analysis. When integrating ESG analysis with traditional financial analysis, Breckinridge’s investment team will consider ESG factors but may conclude that other attributes outweigh the ESG considerations when making investment decisions.

There is no guarantee that integrating ESG analysis will improve risk-adjusted returns, lower portfolio volatility over any specific time period, or outperform the broader market or other strategies that do not utilize ESG analysis when selecting investments. The consideration of ESG factors may limit investment opportunities available to a portfolio. In addition, ESG data often lacks standardization, consistency and transparency and for certain companies such data may not be available, complete or accurate.

Breckinridge’s ESG analysis is based on third party data and Breckinridge analysts’ internal analysis. Analysts will review a variety of sources such as corporate sustainability reports, data subscriptions, and research reports to obtain available metrics for internally developed ESG frameworks. Qualitative ESG information is obtained from corporate sustainability reports, engagement discussion with corporate management teams, among others. A high sustainability rating does not mean it will be included in a portfolio, nor does it mean that a bond will provide profits or avoid losses.

Any specific securities mentioned are for illustrative and example only. They do not necessarily represent actual investments in any client portfolio.

The effectiveness of any tax management strategy is largely dependent on each client’s entire tax and investment profile, including investments made outside of Breckinridge’s advisory services. As such, there is a risk that the strategy used to reduce the tax liability of the client is not the most effective for every client. Breckinridge is not a tax advisor and does not provide personal tax advice. Investors should consult with their tax professionals regarding tax strategies and associated consequences.

Federal and local tax laws can change at any time. These changes can impact tax consequences for investors, who should consult with a tax professional before making any decisions.

Some information has been taken directly from unaffiliated third-party sources. Breckinridge believes such information is reliable but does not guarantee its accuracy or completeness. Any third-party websites included in the content has been provided for reference only.

Certain third parties require us to include the following language when using their information:

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg does not approve or endorse this material or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.